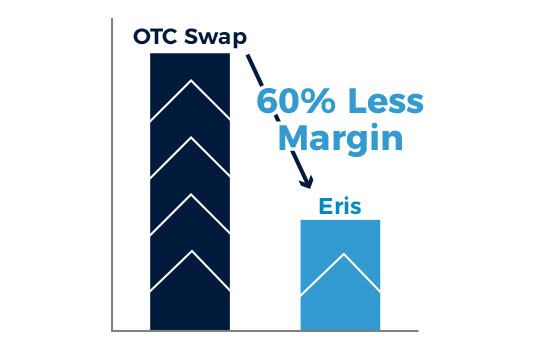

Launched in February 2023, CME Portfolio Margining (PM) dramatically increases the margin efficiency of trading Eris SOFR Swap Futures alongside CME Cleared Swaps. The result is a game-changing increase in liquidity for Eris SOFR 5-10 year products, fueled by multiple swap dealers and swap-enabled futures market makers.

Provides easy access to SOFR liquidity

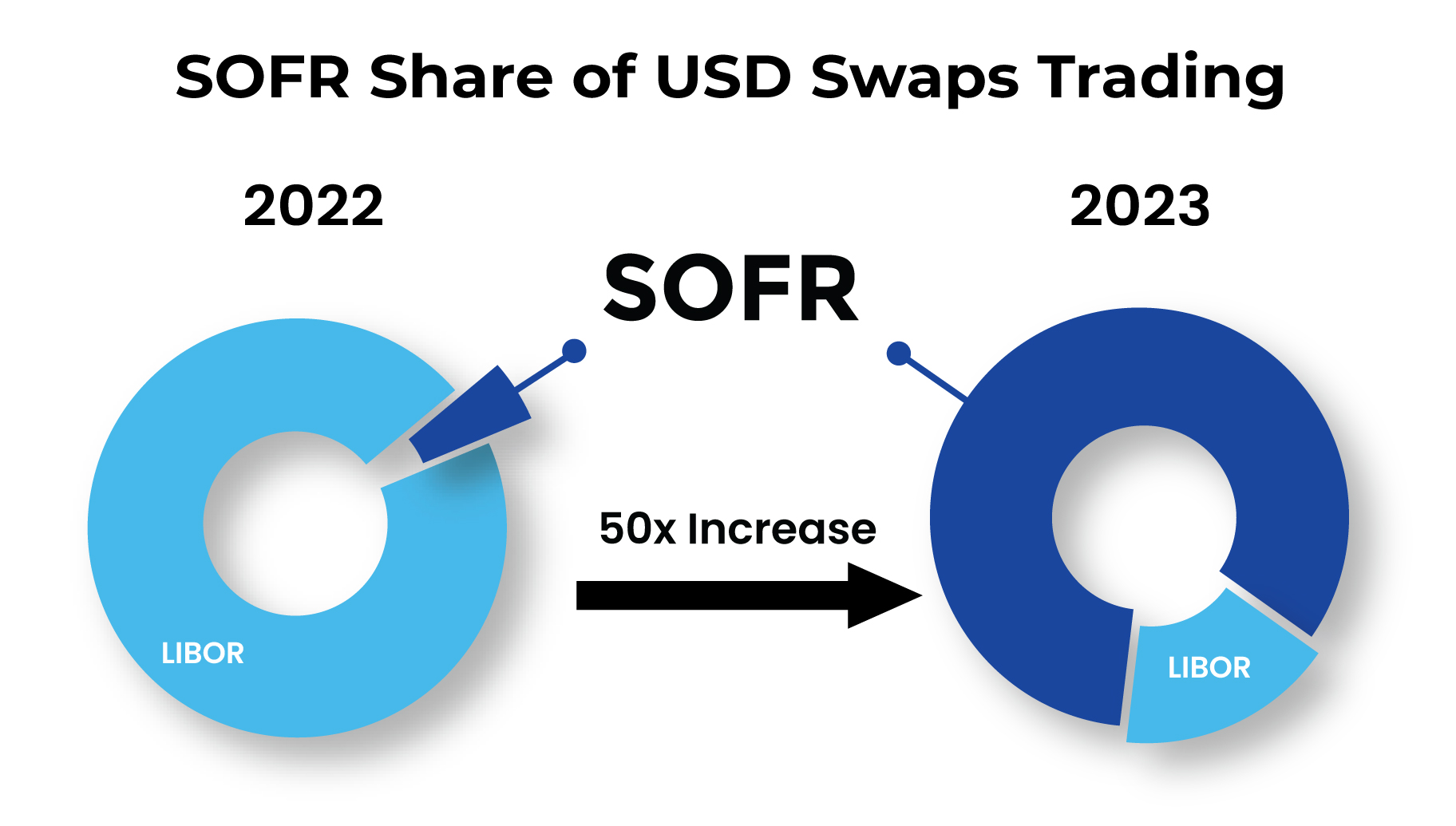

SOFR-indexed derivatives markets have gained dominance and now represent more than 60% of the overall derivative interest rate risk transacted in USD rate markets. Eris SOFR helps widen swap market access to new users, meeting their needs for SOFR swap liquidity as an easily accessible CME Group futures contract.

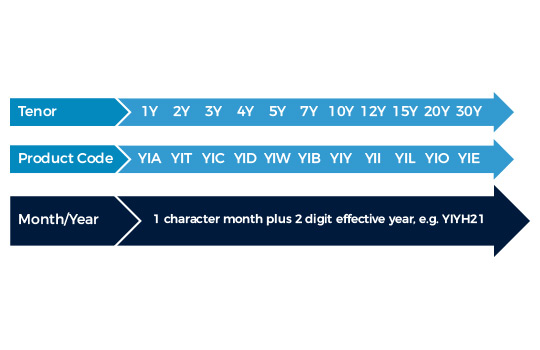

Eris SOFR Swap Futures replicate the cash flows of vanilla OTC SOFR overnight index swaps, including annual fixed payments at a pre-determined rate, and annual floating payments based on daily compounded SOFR. Unlike traditional futures, end users can hold Eris SOFR contracts until final maturity (up to 30 years), both avoiding forced rolls and enabling hedge accounting applications previously reserved for swaps.

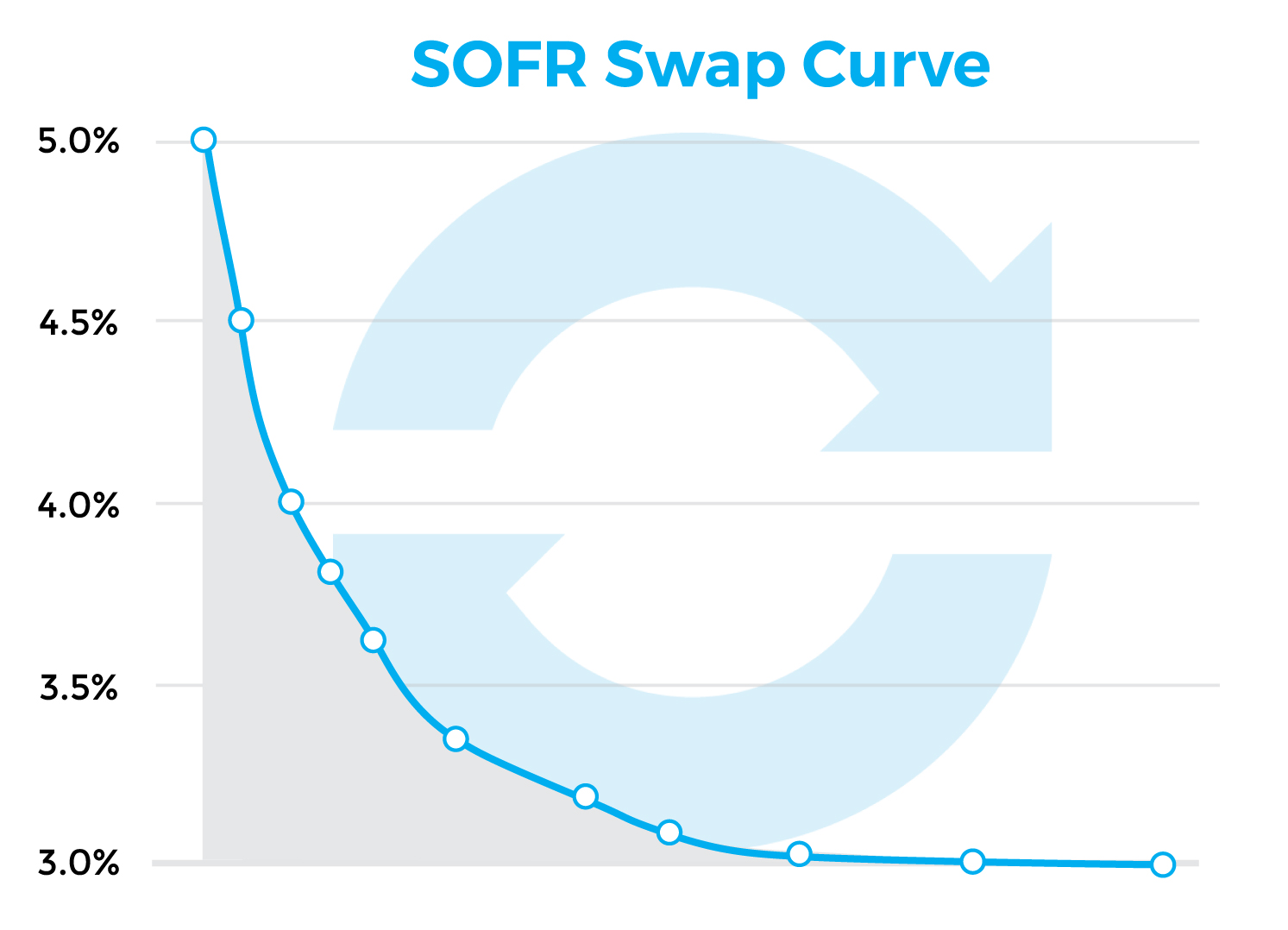

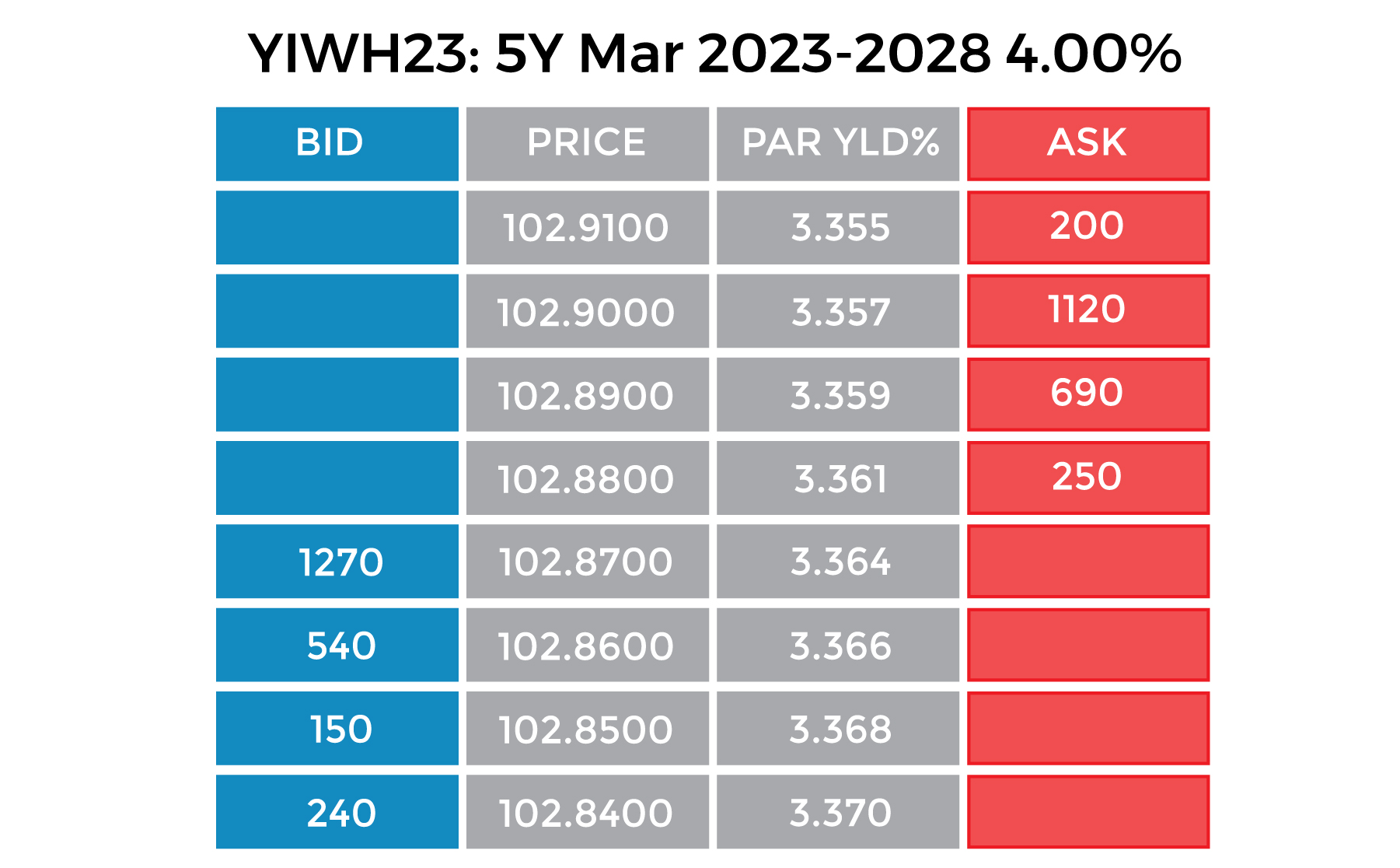

Delivers accessible and transparent SOFR curve

Eris SOFR Swap Futures trade in a central order book market at CME Group, providing visible and executable prices. These markets anchor a live Eris SOFR curve that is used to provide real-time theoretical pricing for all off-the-run Eris contracts that are past their Effective Date. This curve may also be used for benchmarking of portfolio valuation and risk management. For a guided tour of available Eris data, contact us at info@erisfutures.com.

Market volatility has highlighted the importance of efficient margin treatment when capital becomes scarce. Eris SOFR Swap Futures offer the margin efficiencies of CME Group listed futures, including outright levels up to 60% lower than comparable cleared interest rate swaps, and margin offsets with CME cleared swaps, CME 1-month and 3-month SOFR futures, Fed Funds Futures, Eurodollars and U.S. Treasury Futures.

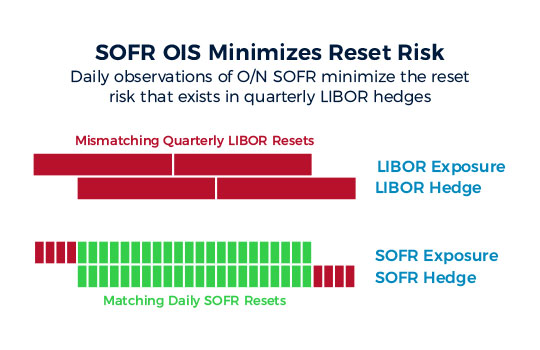

The market's move from quarterly LIBOR swaps to SOFR overnight index swaps significantly reduces hedgers' need for date customization. This fundamental change in swap risk provides a compelling opportunity for end users to adopt standardized products like Eris SOFR Swap Futures, which pool liquidity at quarterly IMM dates and auto-collapse offsetting positions rather than requiring extra steps for compression.

Call your FCM or trade support team to get started. For risk & modeling purposes, Eris and CME distribute a suite of data files including discount factors, Eris SOFR settlement prices, and individual fixed and floating payment details (including accrual dates and SOFR compounding). Contact info@erisfutures.com for a guided tour.

Eris SOFR markets are viewable on Bloomberg, Eris’ website, CME Direct and via all other vendor systems offering CME futures. Block trading through futures brokers is encouraged. To request a Bloomberg Launchpad to monitor Eris prices, click here.

Eris SOFR Swap Futures offer the ease-of-access and operational simplicity of CME futures, enabling traders to view market data and place orders immediately using existing tools, including Bloomberg. CBOT exchange members trade at discounted rates, and all participants enjoy the benefits of CME Clearing trade processing features, including automated give-ups and average pricing.