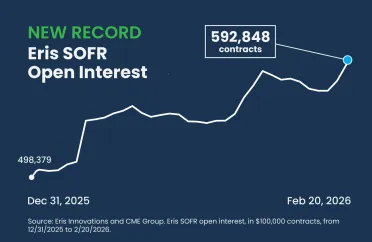

Open interest (OI) increased to 592,848 contracts, up 19% YTD (+94,469 contracts / $9.5B notional) since year-end. Eris/Treasury Swap Spreads (ETSS) aided OI growth with at least 25K contracts ($2.5B notional) traded in each of the 5-year and 10-year ETSS in February.

New indices mark the first time an index provider brings futures-based indices to market using CME Group's Eris interest-rate swap futures

Headline Interview! John Lothian News and our CEO, Michael Riddle, explore Eris SOFR’s success at FIA, Inc. Expo 2025. CME portfolio margining has made Eris SOFR part of the US Dollar liquidity pool, driving volume and shrinking bid/ask. Michael also highlights newer market entrants including REIT’s, regional banks, and asset managers.

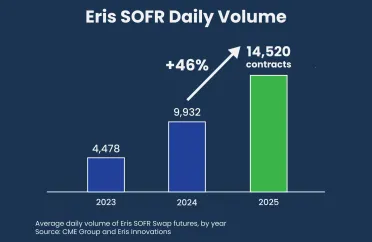

Eris SOFR 2025 Recap: Reaching new heights.Record volume, record participation, and record trade sizes defined the year for Eris SOFR Swap futures, a CME Group interest rates product:-Average daily volume was 14,520 contracts ($1.45 billion notional), up 46% year-on-year. December saw a new monthly high at 34,439 contracts ($3.44 billion notional). More than 80 block trades of +$300k DV01 printed throughout the year.

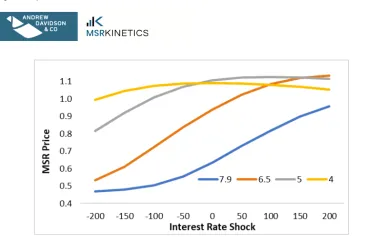

A new hedge instrument, SOFR Swap Futures from Eris, was discussed as an alternative to TBAs and other current hedge instruments because it more directly tracks SOFR risk and provides more efficient use of capital versus swaps.

Driven by growing institutional adoption, 2025 has been a pivotal year for Eris SOFR Swap futures, with open interest (OI) soaring by over 250K contacts since the start of January.

Traditional over-the-counter swaps require months of legal setup, including complex ISDA negotiations and credit reviews, which is often too much overhead for smaller finance teams. Eris Innovations’ swap futures are exchange-listed, meaning they are fully standardized to remove these bilateral frictions entirely.

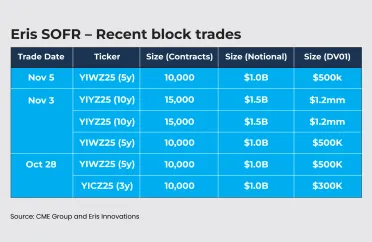

A recent run of $1B+ block trades has powered record growth in hashtag#Eris SOFR open interest, which has nearly doubled YTD.Perhaps not coincidentally, we’re also hiring!

Geoff Sharp discusses the value of using SOFR swaps to hedge non-agency mortgage risk with Robbie Chrisman, and how the entire SOFR curve may be easily and efficiently traded using Eris SOFR Swap futures.