With March 7-10 marking the first Eris quarterly roll following year-end regulatory guidance limiting Libor usage, market participants are poised to migrate to Eris SOFR as they roll from March to June contracts In February, Eris SOFR average daily volume is up nearly 100% compared to Q4 (MTD through February 11) With more than 109,000 contracts of open interest, Eris Libor March positions are expected to roll to Eris SOFR predominantly via block trading, which allows negotiation of two-legged spread trades without execution risk (pursuant to exchange rules) Off-the-run Eris Libor positions will remain tradable until June 2023, then convert in Eris SOFR Swap Futures, according to the CME Conversion Proposal for Eris Libor Products Click Here to read more!

Eris Swap Futures set a new daily record of 108,758 contracts traded on Tuesday, December 7 Coming just ahead of the year-end deadlines for Libor usage, the record surpasses the previous record of 105,925 set June 8As of December 14, total Eris open interest stands at 409,805, an increase of 94% year-to-dateClick Here to Read More

Less than 45 days after surpassing 300,000 open interest for the first time, CME Eris Swap Futures open interest surpassed 400,000 on October 15 and closed the month at a record 422,550

Front-month open interest has grown more than 400% YTD, ending October at a record level of 148,772 contracts

CME Eris Swap Futures traded an average of 11,398 contracts per day in October, surpassing by more than 25% the previous record volume mark for a non-roll month (9,035 in August 2019)

A substantial portion of this growth is driven by new and existing end user clients using Eris Swap Futures to hedge rate moves during October’s swap curve flattening and the looming prospects of Federal Reserve rate hikes

Click to Read More

CME Eris Swap Futures achieved record open interest of 331,445 on Oct 5, continuing the upward trend from the record-setting 31% growth in Q3

During Q3, open interest grew by more than 77,000 contracts, from 251,833 to 328,957

Notably, OI in the Eris Libor 5-year tenor grew 98% to 81,495 contracts, driven by interest rate hedging from end users

Total OI increased 77% in the past year, including multiple OI records set in Q3 for Eris SOFR and legacy Eris Libor Swap Futures

By year end, CME is expected to announce its protocol for converting legacy Eris Libor positions to Eris SOFR Swap Futures positions upon the cessation of 3-month USD Libor in June 2023

Click to Read More

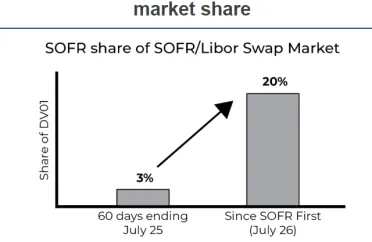

Driven by the SOFR First initiative recommended by the CFTC’s Market Risk Advisory Committee, last week SOFR swaps exceeded 20% of the DV01 traded among SOFR and USD Libor swaps, according to Clarus Financial Technology dataBy comparison, SOFR swaps accounted for just 3% of DV01 traded for the previous 60-day period leading up to July 25The jump in market share shows increased momentum toward meeting regulators’ goal of transitioning away from Libor by year-end“All firms should be moving quickly to meet our supervisory guidance advising them to end the new use of Libor this year,” said Federal Reserve Board Vice Chair Randal K. Quarles in a July 29 press release announcing ARRC’s formal recommendation of Term SOFRClick Here to Read More

Average daily traded volume in outright SOFR overnight index swaps (OIS) surged to $6.7 billion YTD through May, a 235% increase from the same period of 2020

While still a fraction of Libor swap volume, the increase shows the market gaining momentum as participants prepare to cease new Libor use in 2021, as recommended by the Federal Reserve Board and the Alternative Reference Rates Committee (ARRC)

Click to Read More

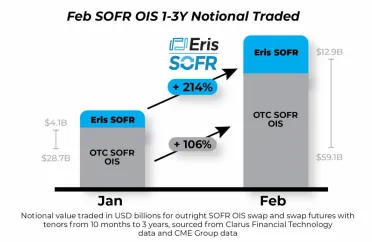

SOFR OIS Volume in 1-3y tenors grew to a monthly record $72.1 billion in February, featuring strong growth from both OTC Swaps (up 106% from January) and Eris SOFR Swap Futures (up 214%) Overall SOFR OIS volume jumped 67% in February to a record $170 billion notional across swaps and swap futures in all tenors, according to data from Clarus Financial Technology and CME Group For more information Click HERE

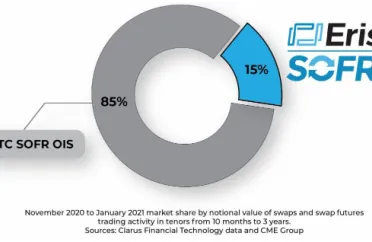

Volume GrowthWith average daily volume of 2,611 contracts from November to January, Eris SOFR accounted for a 15% share of the SOFR OIS swap/swap futures market in the 1-3 year tenors, based on volume data from Clarus Financial Technologies and CME Group. LiquidityEris SOFR bid/ask spreads continue to tighten, with Eris 2y markets in February 0.25 bp or tighter 95% of regular market hours, and Eris 3y markets 0.5 bp or tighter 89% of the time. View the Eris Live Markets page during market hours. Read More Here

Eris SOFR Swap Futures show strong early volume as firms prepare to

migrate from Libor to SOFR

November 16, 2020 – CHICAGO – Eris Innovations, an intellectual property licensing company that

partners with global financial exchanges to develop futures products, today announced the successful

closing of a $2 million investment round. The announcement follows CME Group’s October 5 launch of

Eris SOFR Swap Futures (Eris SOFR), which have averaged more than 3,900 contracts traded per day in

November.

Each of the new investors is affiliated with proprietary trading firms committed to make markets in Eris

SOFR, including Arb Trading Group, Arclight Securities, Clear Capital Group, DV Trading, Sumo and

TransMarket Group. These firms join a group of existing equity holders and affiliates that includes

BlueCrest Capital Management, Chicago Trading Company, DRW, Nico Trading, and Virtu Financial.

“DV Trading sees Eris SOFR as an excellent tool for trading short-end rates, where repo market activity,

crisis-driven Federal Reserve actions and the imminent adoption of SOFR contribute to near-term trading

opportunities,” said Jared Vegosen, Co-Founder of DV Trading. “Our decision to invest in Eris Innovations

was a natural extension of our early involvement in trading Eris SOFR.”

Eris SOFR Swap Futures have exceeded the transaction count of OTC SOFR Overnight Index Swaps

(OIS) for November month-to-date, according to Clarus Financial Technology data, and account for more

than 23% of SOFR swap and swap futures notional value traded in tenors from 1-3 years.

“Eris SOFR addresses the need for additional swap liquidity as market participants look to SOFR as an

alternative to Libor,” said Michael Riddle, CEO of Eris Innovations. “Eris SOFR’s initial traction in the 1-,

2- and 3-year tenors is directly attributable to tight markets streamed by these leading futures proprietary

trading firms, and this investment further increases their alignment in making Eris SOFR successful.”

Eris SOFR Swap Futures are cash-settled futures contracts that replicate the risk exposure of a standard

SOFR OIS transaction, and extend the liquidity of CME Group’s industry-leading SOFR futures complex

out to ten years.

View live markets for Eris SOFR at erisfutures.com/live . Eris Innovations is an intellectual property

licensing company that partners with global financial exchanges to develop futures products based on its

patented product design, the Eris Methodology. Trademarks of Eris Innovations and/or its affiliates

include Eris, Eris Innovations and Eris Methodology. For more information, visit erisfutures.com or follow

us on LinkedIn.