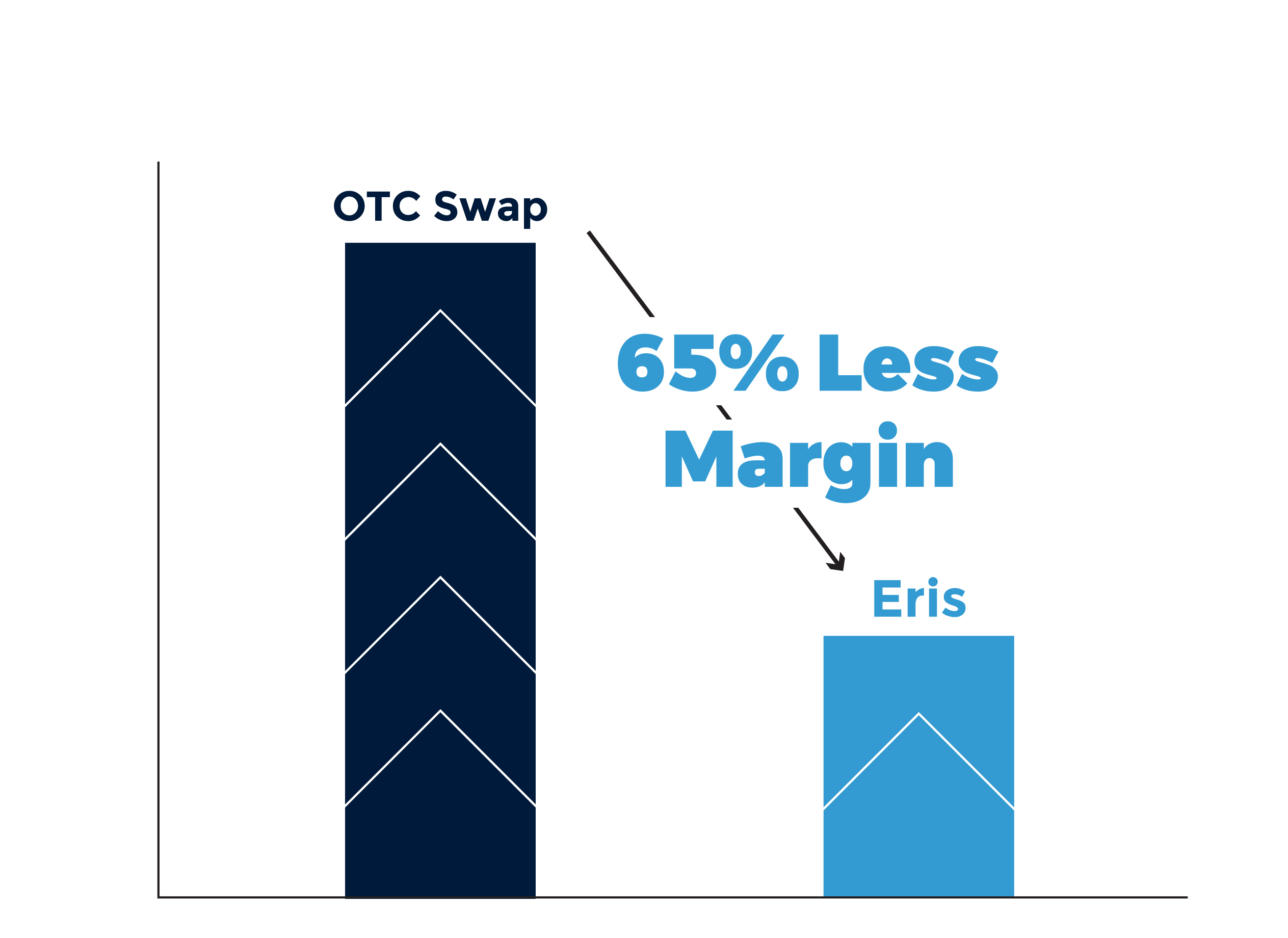

Less than half the margin of swaps

With initial margin levels up to 65% lower than swaps, Eris SOFR Swap Futures provide hedgers significant savings and balance sheet flexibility. Every $100mm of 10-year Eris SOFR saves $3.2mm in IM compared to swaps.

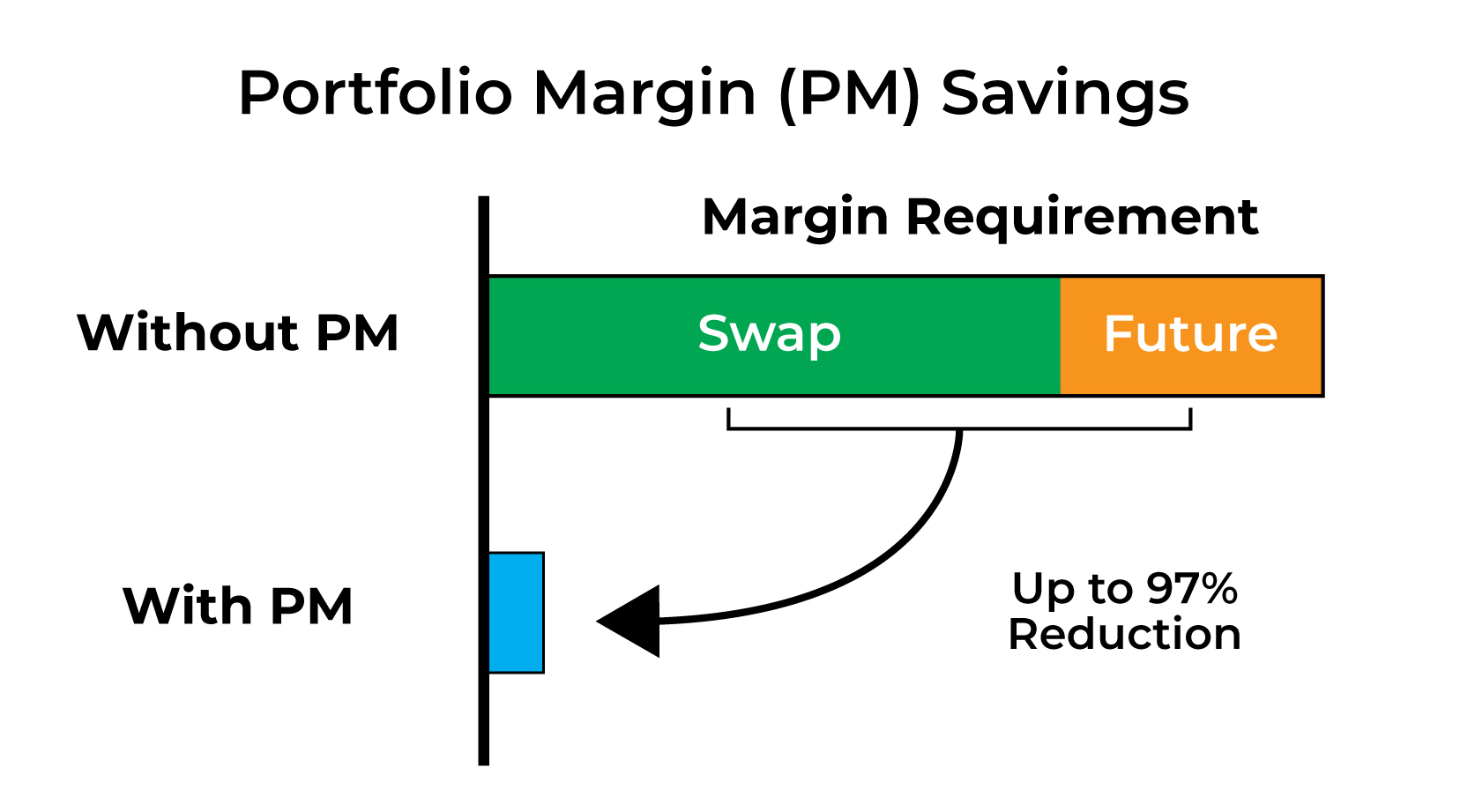

CME Clearing offers up to 97.5% margin offsets between Eris SOFR Swap Futures and CME interest rate swaps, capital efficiency that drives tighter order book prices from swap-enabled Market Makers and increased block market liquidity from swap dealers

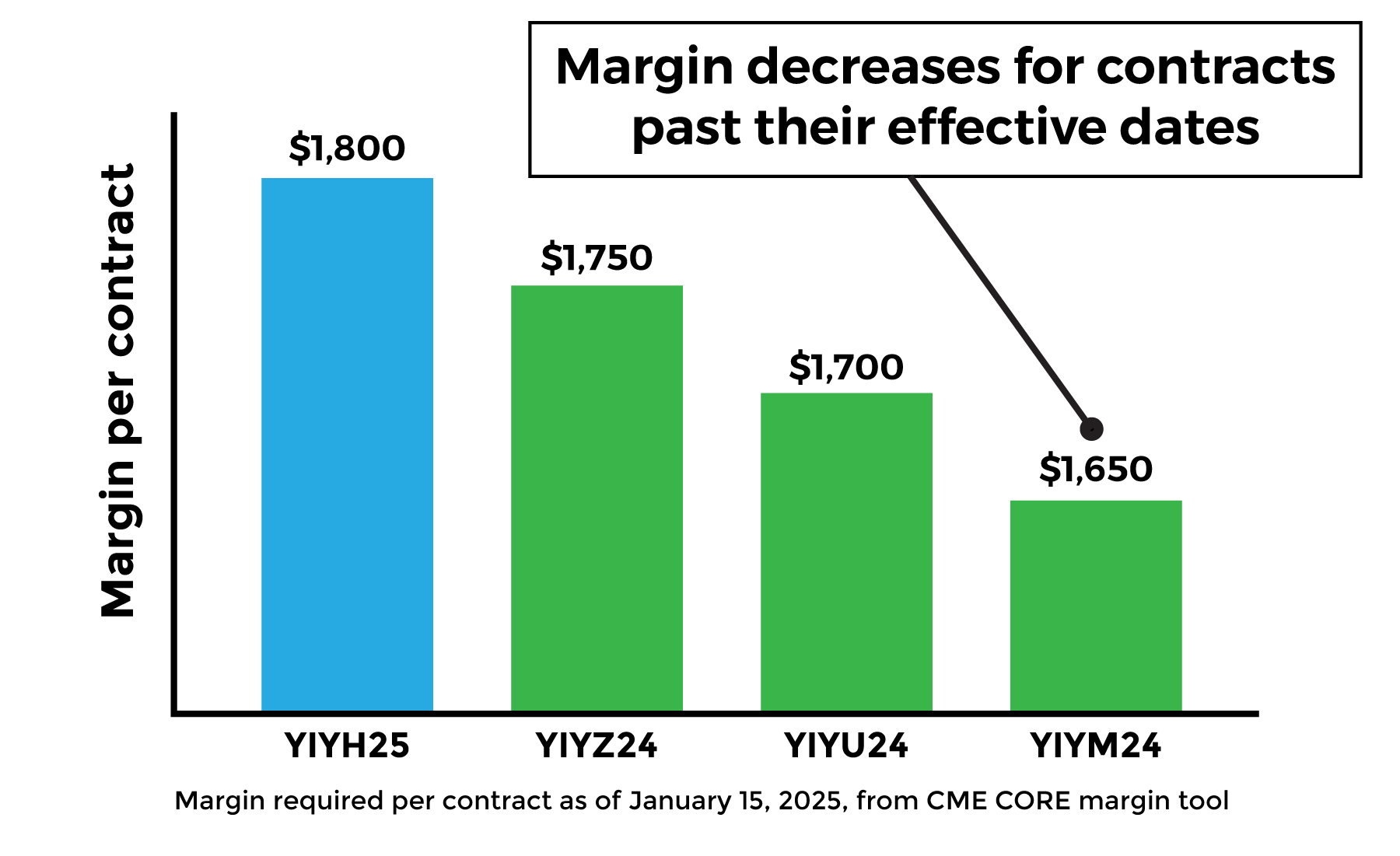

Eris offers web pages to view current margin levels, historical margin, and margin savings vs. swaps. CME Clearing posts Eris SOFR margins , and allows portfolio analysis through its CME Core tool.

CME Clearing collects less margin for Eris SOFR than equivalent IRS, despite their equivalent cash flows, due to regulatory and default management differences between futures and swaps. Initial Margin covers the potential loss on a defaulted position prior to liquidation. Since futures positions from a default are generally liquidated in one day, compared with up to five days required for swap default auctions, less IM is required.

CME Clearing applies consistent margin treatment to Eris SOFR over the life of the contracts, including after the swap effective date. Eris SOFR feature “Eroding margins,” with margin requirements decreasing over time to reflect the diminishing risk as a contract grows closer to maturity.