Background

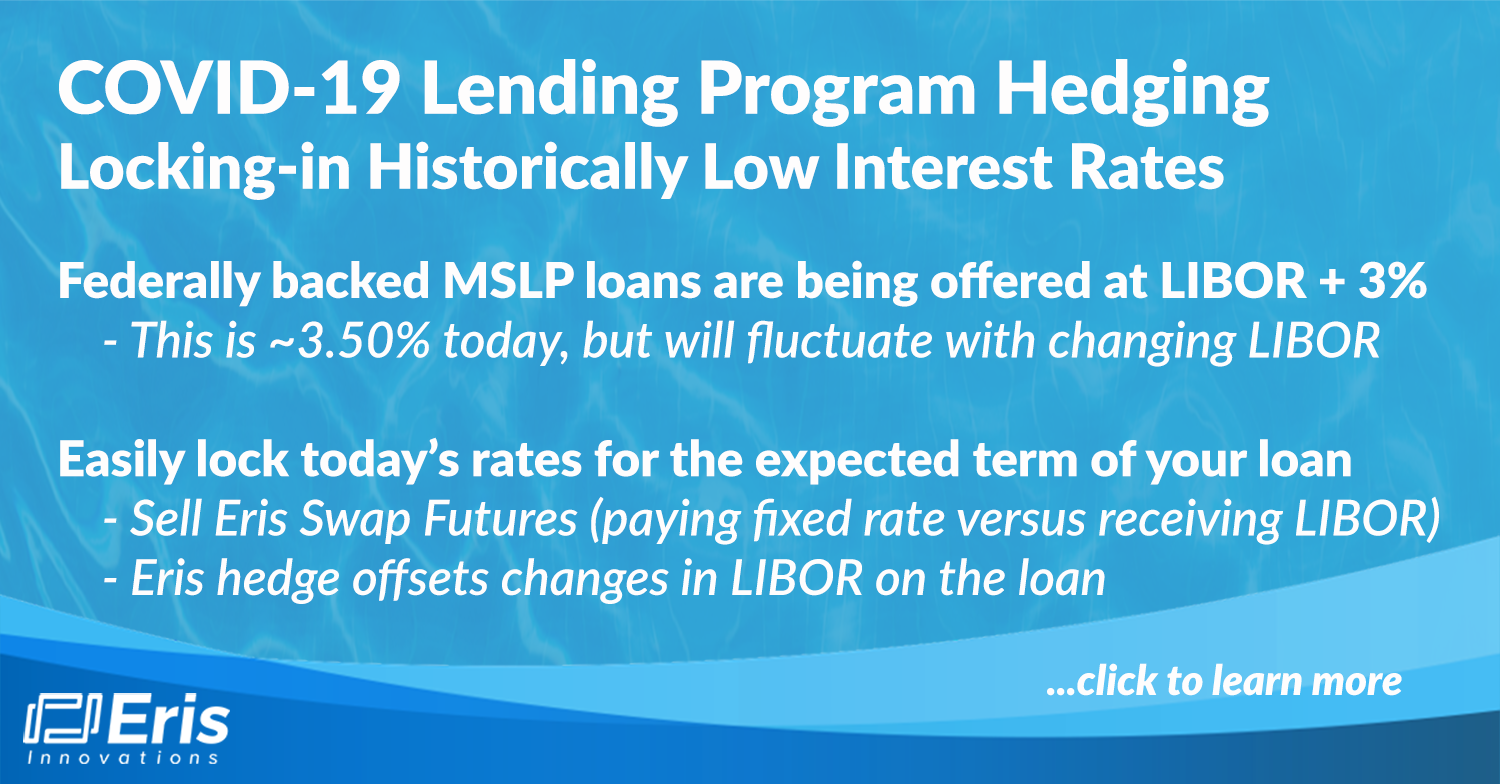

The Federally backed Main Street Lending Program (MSLP) will facilitate up to $600BN in LIBOR based loans for small and medium sized businesses

Eligible loans under the program will be offered at LIBOR +300 basis points, and will range from $500K to $25MM notional, amortizing over 4 years

Why Hedge?

3M LIBOR has fluctuated within an 80bp range between March and April, and uncertainty for the future of the index remains with the impending shift to SOFR

By comparison, 3-4y swap rates recently hit all time lows (0.30-0.35%) having fallen over 130bps from the start of the year

Borrowers can remove uncertainty and lock in fixed rate financing for 4 years at record lows by paying fixed and receiving floating on a swap hedge.

Eris Swap Futures Are Well Suited to Hedging MSLP Loans

The clearing mandate and recent volatility have made traditional OTC interest rate swaps much more expensive for smaller and midsize firms:

- Increased margin/collateral requirements post crisis

- Uncleared swaps may incur significant credit charges

- Minimum FCM fees for cleared swaps of $10-20K per month

Eris Swap Futures offer the exact cash flow economics of OTC swaps, but with less than ½ the required margin upfront, much lower clearing fees, and no credit charge

Borrowers can more efficiently lock-in their all-in financing costs by selling 2, 3, and 4-year Eris Swap Futures (paying fixed and receiving floating) in $100K notional increments mirroring the underlying details of the loan

The example below shows the net borrowing cost on the first $10MM notional of a $15MM loan out to 3 years for a firm that expects to prepay at that time. Increased interest expense due to rising 3M LIBOR will be offset by a gain on the hedge, keeping the effective borrowing cost on that portion of the loan fixed at 3.30%. If the borrower wanted to hedge the full notional, it could sell 50 4Y, 50 3Y, and 50 2Y contracts to replicate the amortizing profile

To Get Started

For those already familiar with trading futures, contact your futures broker

Otherwise, contact info@erisfutures.com

Click here to read more about Eris contract details