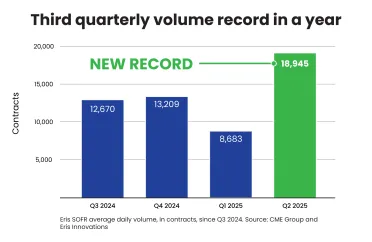

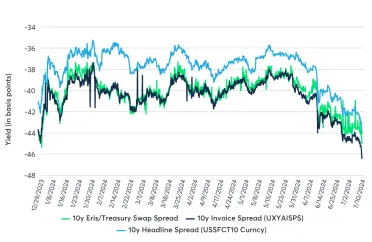

New volume records for Eris SOFR Eris SOFR Swap futures set a new quarterly volume record in Q2, averaging 18,945 contracts traded daily ($1.9B notional), up 142% from Q2 2024June itself was a record volume month, with 33,440 contracts of average daily volume (ADV), up 95% year-on-year, driven by a combination of quarterly roll volume and two “mega block" days described belowMarkets in Eris/Treasury Swap Spreads (tradable spreads of Eris SOFR vs. Treasury futures) tightened notably in June, with 10-year ETSS (YIYU25 vs. UXYU5) 3 ticks (0.36 bp) or tighter 67% of regular trading hours, up from 35% in MayEris/Treasury Swap Spreads average daily volume increased to 1,170 contracts in Q2, with 5-year ETSS (YIW vs FV) the most actively-traded tenor Read More

The 15,000-lot 2-year Eris SOFR trade on April 29 set a new record for largest single Eris SOFR trade leg in notional terms ($1.5 billion)Combined with a 5,000-lot 3-year Eris SOFR traded in the same direction, the two-legged block trade comprised $2 billion of outright risk and more than $425K of DV01Each leg comprised more than 50% of the open interest in its respective contract, demonstrating the ability of market makers to absorb significant size at competitive pricesOpen interest subsequently increased in both contracts (+8,500 contracts in the 2-year, +4 in the 3-year)Read More

A Practical Look at Futures for Interest Rate Risk

Join Derivative Path, CME Group, and Eris Innovations for an insightful discussion on how Eris SOFR Swap Futures provide a new approach to interest rate risk management. This session will provide a practical overview of how institutions can incorporate swap futures into their hedging strategies to realize benefits such as reduced margin requirements, simplified onboarding, and operational efficiencies.

Our panel will break down how these futures work, examine relevant use cases, and explore the implications for hedge accounting, liquidity, and capital optimization. The webinar will include real-world examples and commentary from subject matter experts directly involved in developing and distributing these instruments.

Join Derivative Path, CME Group, and Eris Innovations for an insightful discussion on how Eris SOFR Swap Futures provide a new approach to interest rate risk management. This session will provide a practical overview of how institutions can incorporate swap futures into their hedging strategies to realize benefits such as reduced margin requirements, simplified onboarding, and operational efficiencies. Our panel will break down how these futures work, examine relevant use cases, and explore the implications for hedge accounting, liquidity, and capital optimization. The webinar will include real-world examples and commentary from subject matter experts directly involved in developing and distributing these instruments.

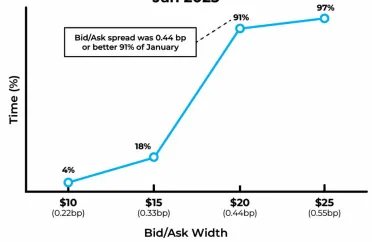

CME Group renews ETSS incentives CME Group recently extended their Market Maker Program for Eris/Treasury Swap Spreads (ETSS) through July 31, providing incentives for participants to stream two-sided markets during regular trading hoursIncentives helped fuel the recent increase in liquidity in ETSS markets, where the 5-year ETSS bid/ask spread was tighter than 0.44 basis points 91% of JanuaryAs exchange-listed spreads of Eris SOFR Swap futures vs. CME Treasury futures, ETSS enable electronic trading in an anonymous, continuously-quoted order book market, with futures margin efficiencyETSS users include hedgers (transferring between Eris SOFR and Treasuries), algo brokers (executing for dealers and hedge funds), proprietary traders (taking views on swap spreads) and market makers (hedging Eris SOFR block flow)For more information, reply to this email to contact Eris InnovationsRead More

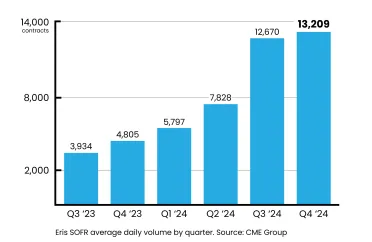

Record Eris SOFR volume grows for fifth straight quarterWith strong volume in the final week of December, Eris SOFR ended a record volume year with a record volume quarter, averaging 13,209 contracts traded daily in Q4December average daily volume of 29,906 contracts (nearly $3B daily notional) also set a monthly record, surpassing September 2024Quarterly roll activity propelled a new daily volume record of 299,509 contracts on December 10Read More

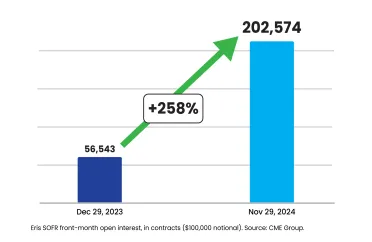

Eris SOFR open interest continued its recent growth, with front-month OI reaching 200,000 contracts for the first time on November 15, 2024Total open interest exceeds 321,000 contracts, up more than 90% year to dateEris Innovations’ CEO Michael Riddle credits the recent growth to CME Portfolio Margining (PM). “Hedgers can think about open interest differently in a contract like Eris SOFR where market makers have such efficient swap hedges in the same clearinghouse,” he said. “For example, 16 times this year we’ve seen front-month OI in 10-year Eris SOFR grow by at least 5% in a single day, reflecting hedgers’ confidence in amassing sizable positions.” Click Here to Read More

One market dynamic that accompanied declining interest rates during the first three quarters of 2024 is a notable increase in hedging of mortgage servicing rights (MSR) assets. Public company filings and conversations with mortgage hedging software providers and advisors shed light on the reasons behind this trend in MSR asset hedging, including the use of SOFR-based valuation models and the advantages of Eris SOFR Swap futures over traditional interest rate swaps.Click Here to read more on CME Group

Trade swap spreads with futuresTrading swap spreads with Eris SOFR swap futures and Treasury futures as CME Globex inter-commodity spreads unlocks the benefits of liquid, anonymous, electronic futures markets. Welcome to Eris/Treasury Swap Spreads.Read More

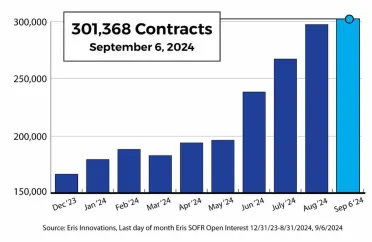

Open Interest hits 300KEris SOFR open interest hit 301,368 contracts on September 6, less than three months after crossing 200K in JuneFront-month open interest stands at 179,171, having more than tripled in 20245-year and 10-year front-month open interest are each more than 70,000 contracts, each having surpassed 50,000 since the June rollRead more