Private lenders who borrow at floating rates indexed to the Secured Overnight Financing Rate (SOFR) and lend at fixed rates bear the risk of interest rate increases diminishing their net interest spread and impairing the resale value of the loan. Now, they can hedge this risk using Eris SOFR Swap futures (Eris SOFR) to match the rate terms of financing with the rate terms of the loan, offsetting losses from interest rate increases.

With Eris SOFR, private lenders can…

Expand product offering to include fixed rate loans, confidently lending at competitive fixed rates while borrowing remains indexed to SOFR.

Price loans to match hedges by referencing the transparent and executable Eris SOFR curve.

Hedge efficiently during loan aggregation in sizes as small as $100,000, allowing for more competitive bulk pricing.

Hold Eris SOFR hedges for the entire duration of on-balance-sheet loans (with no requirement to roll positions quarterly, unlike traditional futures) or lift hedges when loans are sold.

Track transparent pre-trade and post-trade prices, supporting efficient risk management and operations.

Download PDF

Learn more at CME Group

Simplifying bank and credit union access to FASB-eligible hedges

Higher interest rates and deposit instability highlight the importance of duration hedging. Eris SOFR Swap futures (Eris SOFR) provide banks and national credit unions (NCUs) the simplicity of CME Group exchange-listed futures to hedge exposures to interest rate volatility replacing cumbersome OTC interest rate swaps.

Exchange-listed futures: Transparent, low-cost alternative to OTC swaps

Hedgers use Eris SOFR as a preferred alternative to OTC interest rate swaps. As futures contracts listed by CME Group, Eris SOFR offers market participants the economic performance of a standard, fixed-versus-floating rate interest rate swap and the advantages of using U.S. futures:

Straightforward futures paperwork: No ISDA agreements with dealer counterparties

Trade using a traditional futures account and broker, the same workflow one would use to trade CME Treasury futures or three-month SOFR Strip futures.

Traditional pricing and operational simplicity: Reduce expensive overhead and risk management

View independent and transparent prices provided by CME Group, simplify settlement, cash processing, and obtain daily valuation and risk parameters in one easy solution. Execute electronically or via blocks to further refine hedges.

Capital-efficient futures margin: Post up to 65% less than cleared swap or uncleared margin

Save significant capital by reducing the amount of initial margin posted to collateralize positions.

Eligible for FASB hedge accounting (FAS-133/ASC-815)

Like interest rate swaps, banks and NCUs may use Eris SOFR Swap futures to reduce income statement volatility by applying fair value or cash flow hedge accounting.

Download PDF

Learn more at CME Group

For years, owners of mortgage servicing rights (MSR) assets have hedged using Eris Swap futures, enjoying the cash flow performance of interest rate swaps in a transparent, easily-tradable listed futures contract requiring less than half the initial margin (IM) of cleared interest rate swaps. Interest rates surging to levels well above the majority of servicing coupons has generated significant mark-to-market gains for holders of MSRs created prior to 2022. Investors of all sizes, even those with small servicing balances, can lock in these gains by hedging with Eris SOFR, mitigating the MSR price impairment a rates rally would cause.

SOFR hedges minimize unexplained P&L versus valuation models

The uneven development of SOFR liquidity during the market’s transition away from LIBOR in recent years complicated MSR valuation models and led many MSR holders to switch their hedges from LIBOR-based swaps to U.S. Treasuries. Today, SOFR markets have met or surpassed historical LIBOR markets in depth and liquidity, and the spread between SOFR and Treasury rates has moved ten basis points or more in some months. With interest rates hitting levels not seen in decades, choosing hedges that align with the SOFR-based inputs of MSR valuation models is crucially important. By integrating Eris SOFR Swap futures into their risk management models and hedging strategies, MSR investors can ensure high hedge correlation and low unexplained profit and loss.

Tracks SOFR, aligning with MSR risk management models

Ensure your hedges align with the SOFR-based inputs of your valuation model, given recent volatility in SOFR/Treasury spreads.

Returns SOFR-based interest on variation margin (VM)

Funding VM when rates move against your hedge costs less with Eris SOFR than other futures, as the contract design embeds receiving overnight interest at SOFR (price alignment interest).

Saves capital with efficient futures IM

Post collateral up to 65% lower than equivalent cleared IRS positions, preserving the flexibility to use capital elsewhere. Example: Every $30mm of 10-year Eris SOFR saves $1mm in IM.

Download PDF

Read at CME Group

Effective interest rate risk management can often drive success or failure for leveraged investors. Fortuitously, CME Group has Eris SOFR swap futures for investors to easily meet the many challenges in today's dynamic interest rate market. From aggressive FOMC rate hikes from near zero percent to over five percent; cessation of LIBOR at the end of June 2023; and evolving banking events; challenges abound. Complicating matters further, interest rate volatility also moved to a higher plateau, driving margin requirements and capital usage higher as well. Correct product selection can improve hedging robustness and capital efficiencies.

REITs – Leverage, Cap Rates, and Returns

Real Estate Investment Trusts (REITs) are traditional leveraged investment vehicles that must focus on their interest rate hedging needs. REITs use investor funds as well as borrowed monies to purchase real estate assets. The difference in earnings on the assets and the expenses of the debt liabilities is returned to the investors. Getting both the balance of the amount of debt and the cost of the debt is critical to the success of a REIT structure. According to Nareit, a well-known REIT research and data organization, the debt to market asset ratio is at its long-term average of 35%, but has been known to be close to 40% a few years ago.

Nareit also noted that many REITs “termed-out” their liabilities, but a considerable amount of floating rate debt remains and roll-down of the existing liabilities to shorter maturities requires new interest rate risk management to manage the growing gap between the longer-dated assets and the shorter duration on the liabilities.

When REIT operating revenues are high on the operating assets, it is possible to absorb higher interest rate expenses on the liabilities. The standard measure for REITs is called a cap rate, which is the ratio of the net operating income of a property to the asset value of that property. With asset prices increasing and costs rising, cap rates have been depressed since 2019. While they have improved from their lows in 2022, worryingly low cap rates have recently recovered but turned lower again. There are a variety of complex factors that drive cap rates and many of them are not immediately controllable.

Download PDF

Read More at CME Group

Eris SOFR is featured in a recent case study from Hedgestar, an independent provider of outsourced valuation and hedge accounting services

It’s a real-world example of a Texas-based bank using Eris SOFR to protect against rising interest rates, and the positions were assigned as FASB fair-value hedges

Many banks considered swap hedges in 2020-2021; the simplicity of Eris SOFR helped this bank move forward quickly and lock in rates before they rose more than 500 basis points

This recent article from CME Group’s Eric Leininger provides additional insight on Eris SOFR for Bank Asset/Liability Management

Click Here to Read More

10-year Eris SOFR markets tightened in August, including a best bid/ask spread within 0.5 basis points for 25% of regular trading hours, and within 0.75 bp for 85% of the time, according to BMLL Technologies data

Tightening prices are driven by market makers realizing capital efficiencies from CME’s recent addition of Eris SOFR to its cleared swap portfolio margining offering

Need help finding Eris SOFR markets on Bloomberg? Here is an example of the Bloomberg Launchpad for Eris Markets, which you can request directly from Eris

Click Here to Read More

Driven by capital efficiency improvements from CME’s late-Feb introduction of Portfolio Margining, Eris SOFR swap futures order book liquidity has grown tighter and deeper

10-year Eris SOFR has benefited most, with a 5X increase in quoted size and more than 50% reduction in average bid/ask spread since January

10y open interest increased to 19,776 contracts, recently setting trading volume records for roll and non-roll months

Click Here to Read More

Funds to fuel growth as CME Group portfolio margining unlocks swap dealer liquidity for Eris SOFR Swap Futures

March 8, 2023 – CHICAGO – Eris Innovations, an intellectual property licensing company that partners with global financial exchanges to develop futures products, today announced the closing of a $7.2 million strategic investment round. The announcement follows the February 27 addition of Eris SOFR Swap Futures (Eris SOFR) as products eligible for portfolio margining with interest rate swaps cleared by CME Group.

Each of the investors is affiliated with companies that trade Eris SOFR, including DV Trading, DRW, Virtu Financial, ARB Trading Group and Arclight Securities. As part of the deal, Jared Vegosen, co-founder of DV Trading, has joined the Eris Innovations board of directors.

“The recent inclusion of Eris SOFR in swaps portfolio margining is a defining moment for the Eris business,” said Vegosen. “DV Trading has been an active market maker in Eris SOFR since its launch, and we plan to grow our presence to provide end users with the benefits of tighter markets.”

Portfolio Margining reduces by 85-95% the cost of holding Eris SOFR positions against offsetting interest rate swaps cleared by CME Group. These savings help swap dealers and other market makers satisfy demand from market participants, especially leveraged investors taking advantage of Eris SOFR’s efficient futures margin levels to decrease their cost of hedging. A list of swap dealers offering block markets in Eris SOFR is available at erisfutures.com/blockmm.

“The next chapter of the Eris growth story starts this week, as swap dealers and Eris partner firms leverage portfolio margining to ramp up their activity in Eris SOFR,” said Michael Riddle, CEO of Eris Innovations. “We appreciate the vote of confidence from investors who share our vision of Eris SOFR as a liquid benchmark futures contract, and welcome Jared to the board.”

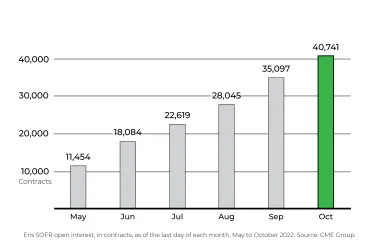

Eris SOFR Swap Futures are cash-settled futures contracts listed at CME Group that replicate the risk exposure of a standard SOFR overnight index swap, with tenors from 1-30 years. End users carrying directional Eris SOFR positions can expect to save 50-70% in initial margin compared with an equivalently-structured cleared interest rate swap. Eris SOFR open interest has increased more than 150% since June 1.

###

About Eris Innovations

View live markets for Eris SOFR at erisfutures.com. Eris Innovations is an intellectual property licensing company that partners with global financial exchanges to develop futures products based on its patented product design, the Eris Methodology. Trademarks of Eris Innovations and/or its affiliates include Eris, Eris Innovations, Eris SOFR and Eris Methodology. For more information, visit erisfutures.com or follow us on LinkedIn.

Media Contacts:

Michael Riddle, CEO

michael.riddle@erisfutures.com

Geoffrey Sharp, Managing Director,

Head of Product Development & Sales

geoffrey.sharp@erisfutures.com

Eris SOFR Swap Futures open interest stands at 40,741 contracts as of October 31, setting a daily recordOctober was a record month for block trades in Eris SOFR, with 33,962 contracts (nearly $3.4 billion notional)3y Eris SOFR OI is 13,387 contracts, having grown more than 10X since MayClick Here to Read More